Let us help you focus on what matters.

At GSD Bookkeeping, we understand that traditional systems don’t always fit the way neurodivergent brains work. That’s why we tailor our cloud bookkeeping services to help small businesses like yours create financial systems that truly support your goals.

We take the stress out of managing your numbers so you can focus your energy where it matters most: growing your business, connecting with customers, and pursuing your passion. Let us handle the details so you can thrive your way.

Do you feel overwhelmed with your finances, have a backlog, or feel like it’s all “just a mess”?

Do you have difficulty misplacing receipts, invoices, or other important financial documents, making tax preparation or audits more stressful?

Do you struggle to track and predict cash flow, causing stress over covering expenses?

Do you need financial support from someone who understands your unique needs and works with you, not just for you?

How we help you.

As neurodivergent business owners ourselves, we understand there are unique challenges. We don’t just do your bookkeeping, we are committed to making the process as accessible, supportive, and effective as possible.

Our goal is to remove the stress and confusion from bookkeeping and create systems that work for you.

Here are just a few ways we tailor our services to support you:

We’ll talk with you in the onboarding stage about a personalized accommodation plan, from specific ways you would like us to communication with you to practical support you need from us.

We’ll help implement and automate systems for invoicing, expenses tracking, and payroll to minimize manual tasks.

We’ll provide tools like checklists, templates, or reminders to help you stay organized and on track.

All monthly financial reports are provided along with a visual dashboard of key metrics. We are continuously developing and evolving our best practices for providing visually intuitive information.

We will always provide a judgment-free space where you can feel comfortable discussing past mistakes or ongoing struggles with finances.

What you can expect:

-

Our introduction meeting is an opportunity for us to get to know each other and see if we’re the right fit for your bookkeeping needs. It’s a relaxed and conversational session where we focus on understanding your business, your goals, and how we can best support you.

Here’s what we’ll cover:

Getting to Know You

Sharing Our Approach

Reviewing Your Current System

Identifying Your Needs

This meeting is all about building a foundation of trust and understanding. Whether you’re starting fresh or need help untangling a financial mess, we’re here to support you every step of the way.

-

After our introductory meeting, we’ll take everything we’ve learned about your business, needs, and goals to create a personalized bookkeeping proposal. This step is all about ensuring clarity and alignment before we move forward together.

Here’s what the proposal process looks like:

We’ll design a detailed proposal tailored specifically to your business.

Along with the proposal, we’ll include a summary of key points from our discussion to ensure everything aligns with your needs and priorities.

We’ll schedule a follow-up call or meeting to go over the proposal together.

Once you’re comfortable with the plan, you’ll approve the proposal and we’ll finalize the agreement.

This process ensures you have all the information you need to make a confident decision, and we have a clear roadmap to begin supporting your business effectively. We’re committed to setting you up for success right from the start!

-

Once you approve your personalized proposal, we’ll move forward with the agreement and onboarding process. This step is designed to ensure everything is clear and seamless as we begin working together.

During the onboarding call, we’ll:

Review your current financial systems in detail.

Gather any access credentials, documents, or data needed to start managing your books.

Walk you through the tools and processes we’ll be using together.

Answer any questions you have about what’s next.

This structured process ensures a smooth and efficient transition, so we can dive into supporting your business as quickly as possible. From start to finish, we aim to make every step clear, stress-free, and customized to your needs.

-

Depending in the bookkeeping package chosen, ongoing services include:

Day-to-Day Bookkeeping such as recording and categorizing transactions, reconciling accounts, and managing accounts payable and receivable.

Financial Reporting including monthly or quarterly financial statements (profit and loss, balance sheet, cash flow). Customized reports to give you insights specific to your business needs.

Tax Compliance Assistance including unlimited communication with your income tax preparer (we can refer you to one), tracking and filing sales taxes as required, and preparing 1099 forms for contractors.

Cash Flow and Expense Management - We can monitor cash flow and assist you in creating projections to plan ahead. We’ll set you up with systems to organize receipts and will analyze spending patterns to identify opportunities for savings.

Regular Check-Ins and Consultations to review your financials and discuss your goals are a MUST to keep informed and updated.

Customized Support - Providing tailored solutions to fit your specific needs, including specialized tools or accommodations for neurodivergent entrepreneurs.

Whether you need help staying on top of daily tasks, preparing for tax season, or planning for growth, we’ll work with you to build a system that supports your success. Let us take the stress out of managing your finances so you can focus on running your business.

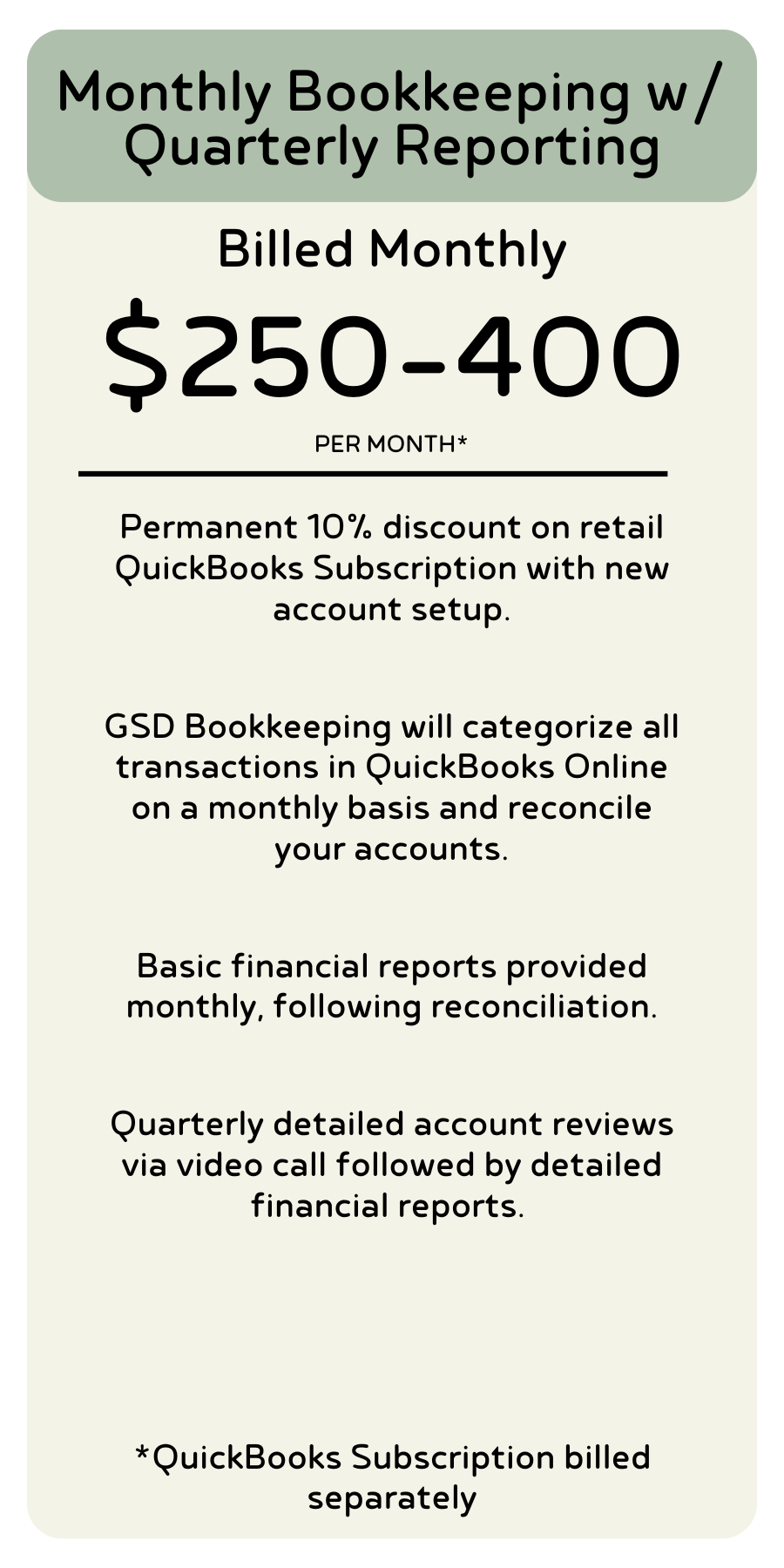

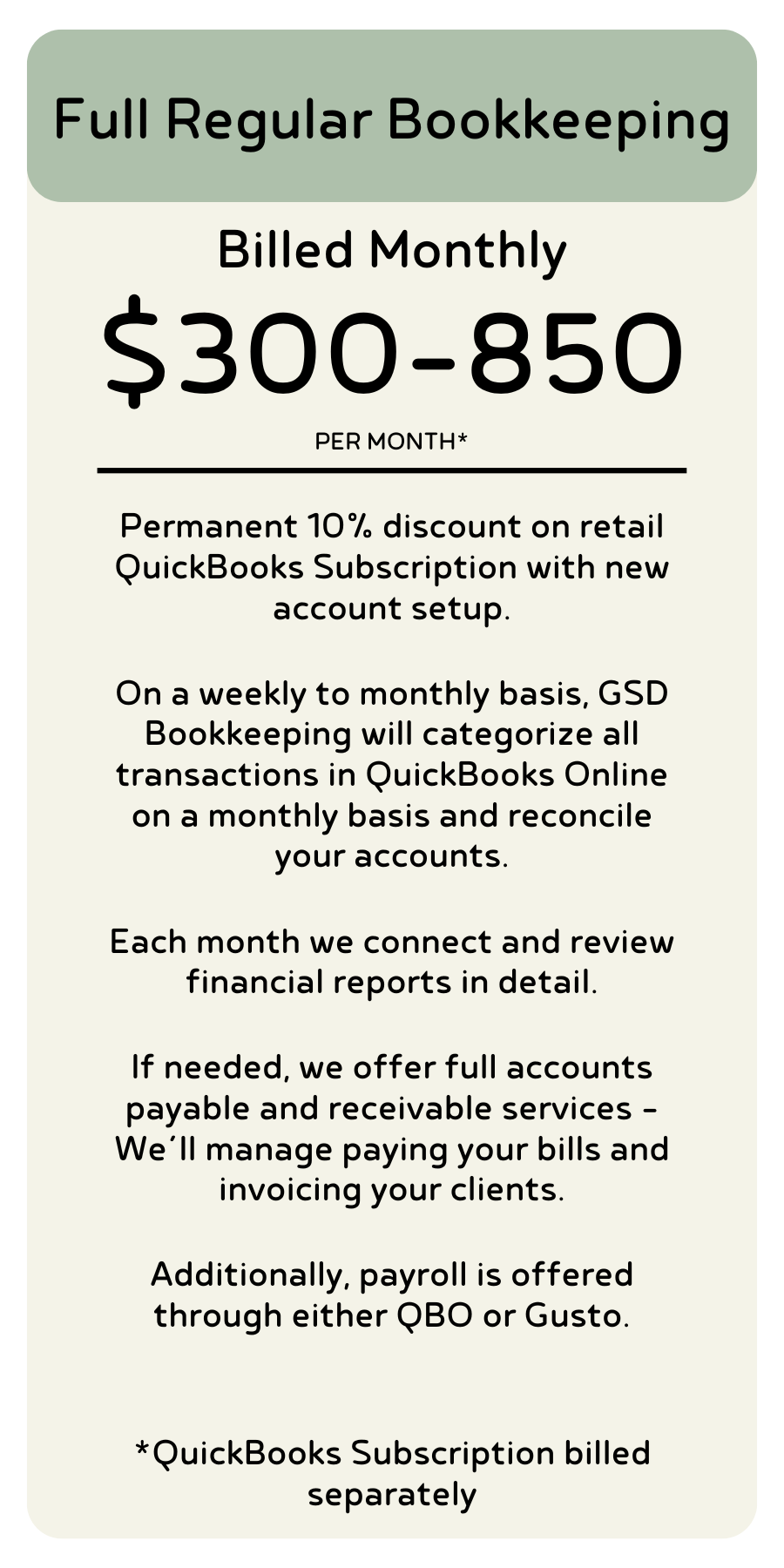

Service Options (Pricing Varies)

Below are examples of the packages we offer. Every account will be individually reviewed and priced based on the services requested or required. If you come from a system other than QuickBooks Online or need your books set up for the first time, we’ll migrate you for free, a $900 value!